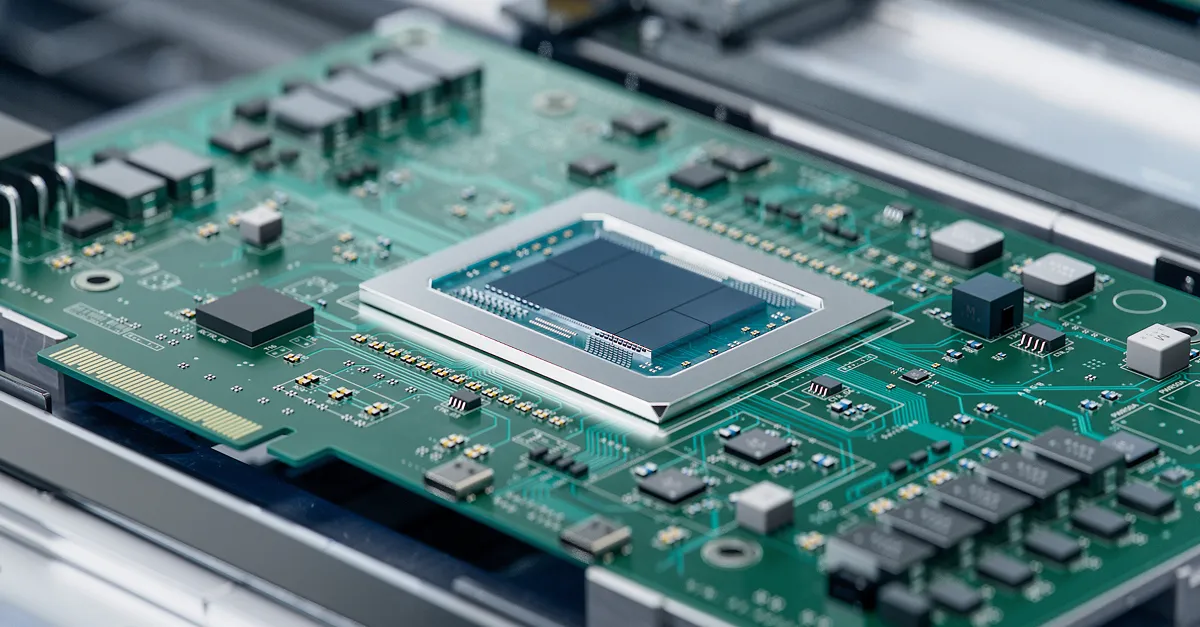

The UK electronics import sector is defined by rapid innovation, narrow margins, and exposure to global supply chain complexities. Effective foreign exchange (FX) risk management is no longer optional—it is essential to retain competitiveness and margin in an industry frequently buffeted by USD/CNY volatility, shifting supplier terms, and unpredictable freight costs. This guide explores the commercial FX risks facing UK electronics importers and procurement finance teams, and outlines actionable strategies and Millbank FX solutions tailored to the sector’s needs.

UK Electronics Imports: The FX Challenge

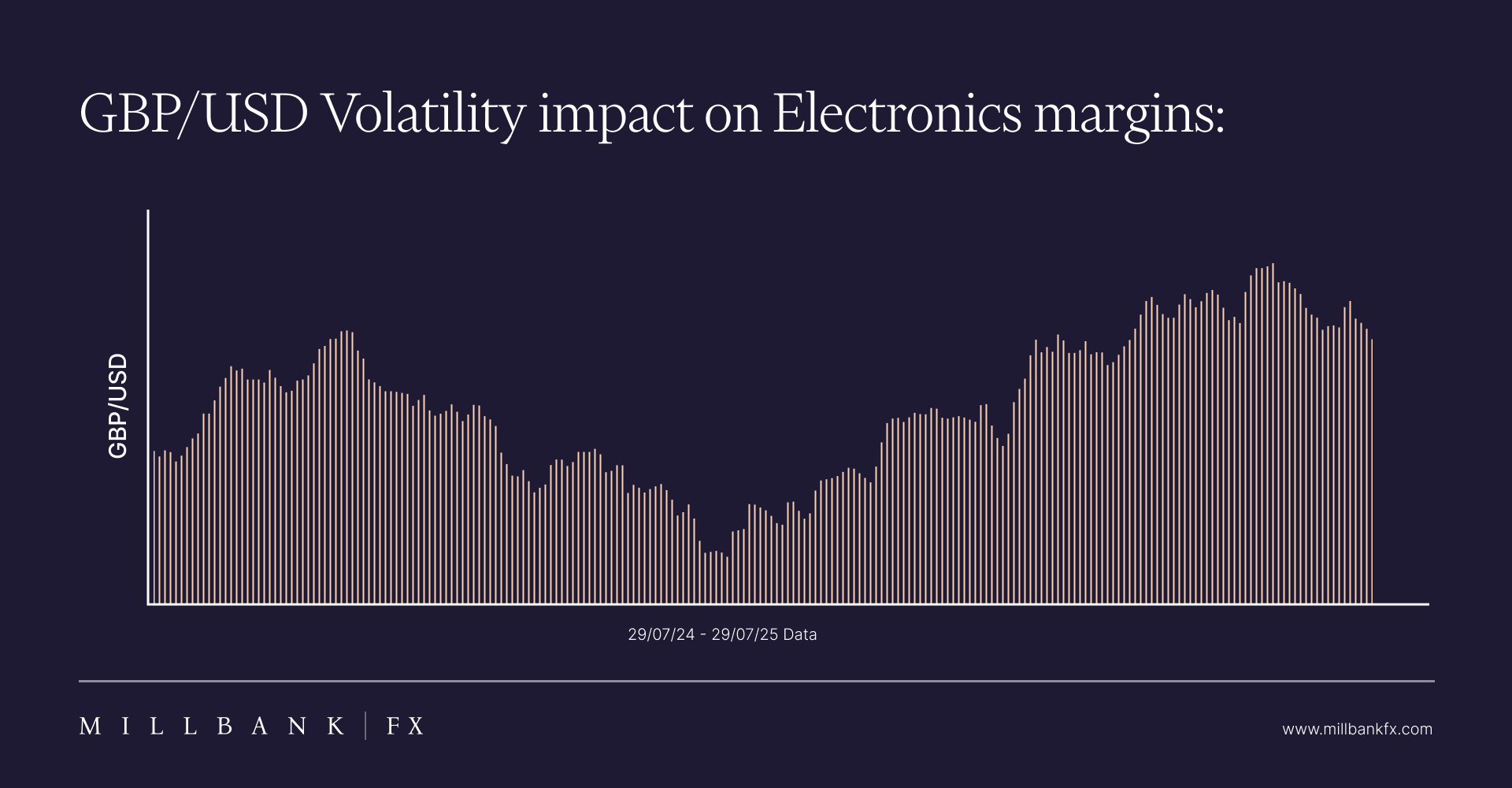

UK electronics importers regularly purchase components and finished goods in US dollars (USD), Chinese yuan (CNY), and euros (EUR), then sell into sterling (GBP) and other European markets. With profit margins often compressed—sometimes as low as 2–5%—even modest currency swings can severely erode earnings or turn a viable shipment into a loss.

Consider a shipment valued at £1.5 million with an anticipated 3% net margin. A 2% adverse GBP/USD move exposes £30,000—potentially the entire margin. Coupled with volatile spot rates, payment lags, and freight delay risks, FX risk management must be proactive and robust, not reactive.

Sector-Specific FX Risk Factors

- Thin Margins: The high turnover and competitive prices in electronics leave little room for error. Unprotected FX risk can eliminate profit entirely.

- USD/CNY Swings: Major upstream costs are often priced in USD or CNY. Tariff changes, geopolitical tensions, and shifting central bank policies can drive short-term and long-term volatility.

- Freight and Delays: Shipping electronics components internationally entails lag times. In the window between invoice and payment, currency rate movement introduces further unpredictability.

- Supplier Pressure: Renegotiating supply contracts or changing order volumes ahead of currency settlement may not always be possible, increasing exposure risk.

Strategic FX Risk Management Tools for Electronics Importers

Successful FX risk management is grounded in a mix of policy discipline, market awareness, and the use of appropriate financial instruments. For UK electronics finance managers, key strategies include:

1. Currency Netting and Natural Hedging

Where possible, align incoming and outgoing cash flows in the same currency. For example, if both supplier payments and some customer receipts are in USD, these naturally offset each other, reducing the net amount requiring conversion. This approach helps cushion margin from short-term currency swings without additional financial products.

2. Spot Transactions

Spot FX transactions convert currency at today’s market rate and are suitable for immediate or unpredictable payment needs, such as last-minute top-ups or small-batch imports. However, relying solely on spot can amplify costs if market rates move sharply during supplier invoicing cycles.

3. Forward Contracts

Forward contracts allow importers to secure a forward rate for a specific currency pair for settlement at a future date, providing certainty for budgeting and margin protection. Forward contracts are binding derivatives and may require collateral if rates move against you. We typically recommend this for orders with committed volumes and known settlement dates—aligning with shipment schedules or seasonal restock cycles.

4. Currency Options

Options provide the right, but not the obligation, to exchange currency at a pre-set rate. While options can offer flexibility if markets move favourably or unpredictably (e.g., new tariff risks), they are generally costlier and often less suitable for SMEs, given upfront premium costs and complexity.

5. Flexible Payment Solutions

Solutions such as virtual currency wallets and multi-currency accounts help streamline incoming and outgoing payments, reducing the need for costly ad hoc conversions and improving supplier relations by enabling payments in their preferred currency.

Example Case Study: Managing FX for a UK Electronics Importer

XYZ Components, a mid-sized UK importer, faced ongoing margin leakage following a shift in USD/GBP in Q1 2024. By implementing a defined FX policy—using forward contracts to secure rates on their largest USD-denominated shipments and currency netting for smaller inflows—they reduced their annual FX cost volatility by over 40%. Supplier negotiation power also improved through predictable payment cycles, enhancing XYZ’s supply chain stability and market competitiveness.

Building a Practical FX Policy

Finance leaders should document a clear FX risk management policy, including:

- Regular forecasting of foreign currency exposure (by currency and time horizon)

- Defining which instruments and strategies to use for key invoice types or supplier terms

- Thresholds for using forwards versus spot or options (e.g., contracts over £50,000 or with lead times over 3 months may be better suited to forwards)

- Periodic review and stress-testing against historic exchange rate moves

Millbank FX: Sector Expertise and Platform Benefits

We specialise in supporting UK electronics importers operating under margin pressure and frequent USD/CNY exposure. Our services include:

- Personal support from experienced FX dealers—no reliance on automated, impersonal systems

- Market-competitive rates with transparent, up-front pricing to aid accurate costing and quoting

- Efficient onboarding and compliance tailored for electronics, so you can secure forward rates and transact within a few hours

- Flexible settlement windows and payment terms aligned with electronics shipment cycles

Most importantly, we prioritise margin certainty by helping you choose the most appropriate risk management instruments—never pushing you towards unsuitable or expensive solutions.

Typical Mistakes in Electronics FX Management

- Delaying FX decisions: Waiting until invoice due dates removes the ability to secure forward rates and guard against margin erosion.

- Poor exposure visibility: Underestimating the scale or timing of currency payments leads to missed opportunities for natural hedging.

- Overspending on complex products: Options and complex derivatives may be tempting, but their cost rarely suits companies operating at scale with repeat exposures.

- Neglecting supplier dialogue: Working with suppliers to accept payment in alternative currencies or to stagger invoices can significantly reduce one-sided exposure risk.

Next Steps: Strengthen Your Electronics Business against FX Volatility

In the current global market, a disciplined FX strategy is fundamental to profitable growth in the UK electronics import sector. With the right blend of currency netting, forward contracts, and specialist support, you can underpin your business’s margin, control unpredictable costs, and maintain a competitive edge no matter how the dollar, yuan, or shipping lanes move.